Content

DPMAnutzerforum 2025: creating the framework conditions for a catch-up race in new technologies

At its key annual event, the German Patent and Trade Mark Office presents an analysis of patent applications concerning digital technologies – after falling behind for years, Germany has recently made up ground – DPMA President: need to get better at turning great potential into protected innovations – keynote of the Federal Agency for Disruptive Innovation

Press release of 24 March 2025

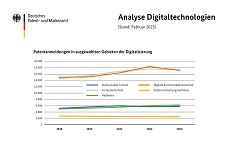

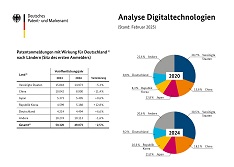

Munich. After Germany had dropped behind in innovations concerning digital technologies for years, German companies made up ground with respect to the number of published patent applications in their domestic market in 2024. Last year, applications from Germany filed in relevant fields of technology saw a considerable increase compared to 2023 (+6.6%). With a total of 4,494 published applications, Germany was fifth in the ranking. By contrast, there was a considerable decline, or only a slight increase, in the numbers from the top three countries. With 14,973 published patent applications (-5.3%), the United States of America once again came in first, followed by China (8,900, -11.4%) and Japan (5,405, +0.6%). With an increase of 12.8%, the Republic of Korea was the only country to see a significantly stronger innovative dynamism than Germany. With 5,188 applications, the Republic of Korea came in fourth.

(Please also see our ![]() Fact sheet Analyse Digitaltechnologien- in German).

Fact sheet Analyse Digitaltechnologien- in German).

The long-term analysis, however, shows that the share of Germany in total applications in the fields under review has decreased: in 2020, 9.8% of all published patent applications concerning digital technologies were filed by German applicants; last year, the figure was as low as 9.2%. Five years ago, Germany took fourth place, ahead of the Republic of Korea. Furthermore, in the key technology field “digital communication”, Germany once again saw a decline in the ranking. The analysis also reveals that there are hardly any German or European companies among the top applicants in the field of digital technologies. It is US and Asian companies that dominate the rankings. But, strikingly, the boom in applications from China seems to have diminished.

“In the past years, when it comes to key digital technologies, Germany has fallen far behind the most innovative countries. The upswing in patent applications now has to be the beginning of a race to catch up,” DPMA President Eva Schewior said. “With its strong technology companies, excellent universities and talented people, Germany has everything it takes to play a key role in digital technologies. We need to get better at turning this potential into protected innovations and then into attractive products and business models. To achieve this aim, the optimal framework conditions have to be created, as we have to secure not only our prosperity, but also our digital sovereignty: the more competitive we are in key digital technologies, the less we depend on international developments,” the DPMA President added.

Agenda of the DPMAnutzerforum 2025

The DPMA President will present the analysis of digital technologies at the DPMAnutzerforum 2025 on March 25th. The German Patent and Trade Mark Office looks forward to welcoming IP experts from industry, law firms and service providers and from science at its key annual event on March 25th and 26th. The keynote will this year be given by Dr Antonia Schmalz of the Federal Agency for Disruptive Innovation (SPRIND). The top-level expert debates and panel discussions concern, among other issues, artificial intelligence, the Digital Services Act and trade mark protection in the virtual world. Moreover, DPMA experts hold workshops and informative lectures on IP rights and their enforcement and on the search in the databases of the DPMA.

Details of the analysis of digital technologies

For the analysis concerning digitisation, we considered published patent applications with effect in Germany at the DPMA and at the European Patent Office, without double counting. Patent applications are published after 18 months. Accordingly, inventions newly filed in 2024 are not included in the analysis. We examined the following fields of technology: computer technology, digital communication, semiconductors, audio-visual technology and IT methods for management.

After some considerable increases, the total number of published applications concerning digital technologies in 2024 was 49,073 and thus a bit smaller than in the previous year (-2.5%).

Computer technology

Most applications were received in the field of computer technology (17,387, -1.6%), which includes inventions relating to image data processing, speech recognition and information and communication technology. Many of these innovations use artificial intelligence or machine learning. In 2024, the international ranking was led by the United States of America with 6,450 publications (+0.5%), far ahead of China (2,247, -14.5%) and Germany (2,076, +6.6%). In a long-term analysis, the share of Germany in total applications in this area has slightly increased. In 2020, the share was 11.1%, last year’s share was 11.9%.

The top applicants in this field are the South Korean company Samsung Electronics Co., Ltd., with 952 patent applications, ahead of the Chinese company Huawei Technologies Co., Ltd., with 797 applications, and Microsoft Technology Licensing LLC (636 applications) from the United States of America.

Digital communication

Second place goes to digital communication with 17,192 publications (-6.6%). Many applications in this category are related to the current 5G mobile phone standard as well as future standards and are therefore important for the digital connectivity in a number of key technologies. Again, the United States of America was the frontrunner with 5,174 applications (-11.4%), ahead of China with 4,608 applications (-11.7%). The Republic of Korea took third place with 1,704 applications (+2.3%), while Germany only reached seventh place with 665 applications (-5.1%). Germany’s already low contribution to the total number of applications saw yet another decrease from 5.4% in 2020 to 3.9% in 2024.

When it comes to companies, the US corporation Qualcomm Inc. published the most applications in this sector. Second place again goes to Huawei Technologies Co., Ltd., which is followed by one of the few European companies represented in this ranking, the Swedish Telefonaktiebolaget LM Ericsson (publ).

Semiconductors

The third-highest number of applications was achieved in the sector of semiconductors (6,228, +3.5%). Semiconductors are crucial for the processing and storing of data and thus the advancement of digitisation. Japan tops this ranking with 1,244 applications (+4.3%), followed by the United States of America (1,202, -6.2%), the Republic of Korea (1,142, +29%) and China (787, -7.8%). Germany took fifth place with 703 applications (+17.4%). Compared to the last five years, the share of German companies in the total number of applications saw a significant decrease, from 14.8% to 11.3%.

Looking at the applicants themselves, the first three places were dominated by the South Korean companies Samsung Electronics Co., Ltd. (406 applications), Samsung Display Co., Ltd. (285) and LG Display Co., Ltd. (218), followed by Taiwan Semiconductor Manufacturing Co. Ltd. (199) from Taiwan.

Audio-visual technology

The sector for audio-visual technology, which covers inventions regarding virtual reality (VR) as well as augmented reality (AR), comes in fourth place (5,752, +1.3%). These fields hold enormous potential for the future of all kinds of business sectors: by creating models of their “digital twins”, everything from products and machines to industrial facilities can be virtually visualised. The United States of America has the highest number of applications with 1,246 (-6.5%), followed by China (1,109, -6.1%), Japan (853, +3%) and the Republic of Korea (846, +24.8%). With 642 published applications (-0.3%), Germany takes fifth place.

In this sector, too, the share of German applications slightly decreased, from 12.1% in 2020 to 11.2% in 2024.

In terms of applicants, Samsung Electronics Co., Ltd. once again has the lead with 325 applications, followed by Huawei Technologies Co., Ltd. and LG Electronics Inc.

IT methods for management

The fewest applications were published for the technology sector “IT methods for management” (2,514, -1.6%). This sector includes procedures for services like reservations and event bookings, workflow control, corporate or organisational planning as well as materials and inventory management. In the international ranking, the United States of America (901, -4.5%) is ahead of Germany (407, +26.4%), closely followed by Japan (403, -10.6%).

Looking at the long-term development, German applicants in this technology sector have gained ground: their share in the total numbers of applications has risen from 14.2% in 2020 to 16.2% in 2024.

The application numbers of individual companies are rather low in this sector, as well as very close together. The German enterprises Bayerische Motoren Werke AG and Siemens AG share first place with 45 applications each, second place goes to Microsoft Technology Licensing LLC with 42 applications.

The German Patent and Trade Mark Office

Inventiveness and creativity need effective protection. The DPMA is the German centre of expertise for all intellectual property rights – patents, utility models, trade marks and designs. As the largest national patent office in Europe and the fifth largest national patent office in the world, our office stands for the future of Germany as a country of inventors in a globalised economy. Its staff of around 2,800 at three locations – Munich, Jena and Berlin – provide services to inventors and companies. They implement federal innovation strategies and develop the national, European and international protection systems.

iStock.com/DmitriyTitov

Last updated: 24 March 2025

Not only protecting innovations

Social Media